The recent spike in oil prices has rekindled the debate on the need to impose a windfall profits tax on private oil companies. The matter has even acquired political overtones in the US presidential elections, with one of the nominees, Barak Obama, supporting the imposition of such a tax.

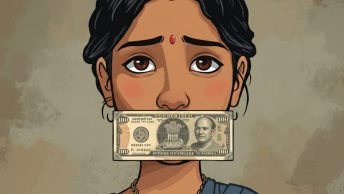

This issue has now reared its head in India as well (perhaps for the first time, to my knowledge). Here too, it has unsurprisingly assumed political proportions. However, there is yet no clear opinion on whether such a tax would be efficient, and as to what could possibly be the implications of such a tax from an economic and legal standpoint. In a previous article, the Hindu Business Line sets out the issue (as follows):

“With global crude oil prices touching new highs, a debate has been triggered on measures to deal with the situation and partially insulate the consumers from the impact.

One such suggestion has been imposition of a windfall profits tax on private/joint venture oil-producing companies and private standalone refineries earning profits through import parity pricing policy.

The Left and other political parties such as the Samajwadi Party have been pressing for levy of such a tax citing examples of countries where the tax has been introduced.”

The article then sets out both points of view on the matter:

“A windfall profits tax is levied on oil companies because of the profits they earn as a result of the sharp increase in oil prices. Industry trackers feel that imposition of such a tax would merely mean extending the burden sharing of high crude prices on standalone refiners, and would not help much in cushioning the retail consumers. Besides, it would send a wrong signal for those who are looking at investing in oil and gas exploration in the country.

…However, the contrary argument is that with high crude oil prices, the product prices also go up, which is measured by gross refinery margins and this is where the refiners gain, thus the refiner should share the burden. Public sector players say that if the tax is levied in lieu of the subsidy burden which they have to bear then it may be acceptable, otherwise it serves no purpose.”

However, more recently, the Hindu Business Line carries a column by Raghuvir Srinivasan that launches a scathing attack on the proposal for windfall profits tax. He argues:

“A windfall profit tax on oil companies now would be illogical and an unwise economic measure; those arguing in favour should look at the experience of other countries that have imposed such a tax in the past, specifically the US, where it did more harm than good to their economy.

…So, what is all this talk of a windfall profit tax then? Such a tax is certainly not going to help bring down pump prices of petrol or diesel. What it will do though is cause immense damage to the already faltering oil companies and lead the government into complex litigation. The rationale for such a tax is completely suspect and can be challenged in the Courts. This is territory not traversed by the government before and could lead to needless complications in an election year.”

This issue is still at the early stages of evolution in the Indian context, but certainly has the potential to throw up interesting legal challenges if pressed forward.