Taxation is omnipresent and makes its presence felt in all spheres of life. From a legal standpoint, when one contemplates on the fundamentals of taxation, the first set of questions which arise are (i) what indeed is ‘taxation’? (ii) what are the essential components of a ‘tax’? and; (iii) such similar other questions. ‘Tax, Constitution and the Supreme Court’ seeks to discuss these fundamental principles of taxation, in a simple and lucid manner.

While tax legislations are constantly in a state of flux, the underlying fundamental principles remain constant. The recent decision of the Supreme Court in the 3rd Jindal case [(2017)12 SCC1], which overruled the ‘compensatory tax theory’ (which itself was a judicially propounded theory which held the field for over 50 years), only bears testimony to this fact. The theory of ‘compensatory tax’ was overruled on the primary grounds that the said theory was contrary to the fundamental concept of taxation, obliterated the difference between a ‘tax’ and a ‘fee’, and, was not recognized by the Constitution.

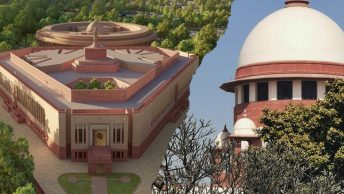

These fundamental principles of taxation continue to be as relevant today as they were in the initial days of the Constitution and the Supreme Court. It is these fundamental principles of taxation, which the book seeks to discuss through the prism of the constitutional provisions and decisions of the Supreme Court from 1950 to 2018.

Editor Note: This is a short blurb from ‘Tax Constitution and the Supreme Court’ by Karthik Sundaram, published by Oakbridge Publishing. The book can be bought here.

Loved this post and shared it with all my colleagues. Thank you so much!

Your article helped me a lot, is there any more related content? Thanks! https://accounts.binance.com/it/join?ref=S5H7X3LP

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.