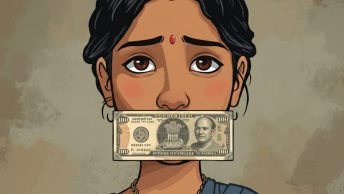

The xenophobia over retail trade has manifested itself once again. The Government (Department of Commerce & Industry) has asked Starbucks to modify its application to enter into a franchise agreement with Kishore Biyani’s Future Group by converting the structure into one where Starbucks directly invests in an Indian entity to the extent of 51% under the single-branded retail route. An editorial in today’s Economic Times has sharply criticized this decision.

Without being drawn into the details of the proposal or its merits, I am struck by a very simple proposition. When the relevant regulations permit foreign retailers to enter into the Indian market through one of two structures, i.e. (i) franchise arrangement, or (ii) investment in an Indian entity to the extent of 51%, should the option of choosing either of these not vest with the retailer? Is it permissible for the Government to compel the parties to choose one option over the other when both are equally available?

It is ambiguities and uncertainties such as these that are keeping several prominent retails brands out of India, although the Indian retail market is burgeoning.

Dear Umakant,

It is refreshing to find issues of company law and corporate governance being discussed on our blog in an easy-to-understand manner. Please continue to post similar issues.

Could you please explain what could have been the plausible reason why the Govt. is against franchise route, and why it prefers investment in an Indian entity? In the case of Starbucks, could you please mention what are Govt.’s specific objections against the franchise agreement with Future Group. Although you have chosen not to go into the details or merits, I think they are important to understand the point which you are making.

I join Mr. Venkatesan in welcoming your posts on commercial law issues. I do so because I feel that those of us who aren’t mainstream commercial law practitioners suffer not just from an informational gap on such issues of economic policy, but also have very different perspectives on these issues. Let me try and articulate that difference, and I apologise for some of the strong language, which is directed not at you, but at the general tenor of arguments raised by those who support polices of free trade in general.

Like Mr. Venkatesan suggests, these issues can’t be discussed fully without going into foundational questions. As the debates and discussions about the OBC quotas issue on this blog demonstrated, very often we differ on processual details precisely because we come from very different worldviews.

I found the linked editorial problematic on various fronts. First, what is the automatic connection between a governmental initiative that raises questions about policies that seek to promote free trade, and “appeasement of the Left?” Can legitimate questions to promote or protect national interest not be raised by any one other than “the Left”? This is an ad hominem attack, and doesn’t advance reasoned discussion.

To that extent, I thought your opening sentence in the post was also problematic. Using “xenophobic” as a rhetorical term is attention-grabbing, but I wonder if it is accurate. Free trade is not a natural phenomenon, and the tone of your post seems to suggest that it is. I think policy issues such as whether and how foreign retailers should be allowed into India should be discussed carefully and logically. As the recent Doha Round WTO discussions show, there are complex problems involved in dismantling protectionist regimes, and talk of ‘xenophobia’ or nationalism isn’t particularly helpful in navigating these muddied waters. By that yardstick, the economies of the U.S. and Europe are ‘xenophobic’ when it comes to issues such as agricultural products. The Business dailies don’t use that kind of rhetoric while discussing those issues. Clearly, each of the nations in the West uses a very pragmatic assessment of current national interest in deciding which areas to allow free trade in, and which to protect. This is precisely what India should be doing to decide the issue of allowing foreign retailers.

The entry of Wal Mart into close-knit communities has been opposed even by those in the U.S. who are otherwise supporters of free trade and policies of liberalisation. Their argument is that retail giants actually harm local economies by supplanting small businesses, and by adversely affecting service conditions of employees who work in such stores.

What is needed is a hard-headed economic assessment of the issue to assess whether allowing mega retailers will suit the Indian economy, and to evolve procedures to facilitate that. The ET editorial bemoans: “India is unique among major emerging markets in banning FDI in retail altogether.”

So what? What the editorial doesn’t tell us is whether India can be so simplistically compared with “major emerging markets” – clearly, given the size of the Indian “markets,” that is a false comparison. Exceptionalism by itself is not a bad thing, if there are sound policy reasons backing it. People who espouse American approaches to economic issues often ignore the fact that American policies are, even within the OECD bloc, exceptional to quite a high degree.

Arun has already made a number of points on free trade, economic policy etc and I will stay clear of those.

Umakanth’s post raises a far more fundamental issue of how we are managing our economic policy, whether liberal, free trade friendly or otherwise. To put it mildly, our regulations are delightfully (and sometimes frustratingly) vague. Nearly all of the regulations/guiding policies that govern foreign investment (whether made by Government of India or RBI) are badly drafted and cause significant confusion in the process. They lack the one fundamental quality that is required- clarity. This is combined with a lack of help from the officials who are actually charged with enforcing these regulations. Anybody who has sought a written clarification from either the Foreign Investment Protection Board or the RBI will testify that the clarifications cause more confusion than the original rule, leaving us none the wiser.

This results in a number of problems regarding regulation of economic activity: a) lack of clarity results in multiple interpretations of rules and regulations that are not susceptible to proper rules of legal interpretation (e.g., interpreting the RBI guidelines is tougher than interpreting the Constitution or a statute which follow certain legal drafting norms); b) the administrative authorities can selectively apply the rules (which happens very often) and nobody knows about these instances as these instances are not reported or even if reported reasons are not known (in effect, you are left craving for even a vague judicial decision!); c) number of lawyers and ex-bureaucrats who claim to be close to the RBI/FIPB or whatever ministry give opinions (and more often than not obtain some sort of letter from the authorities) which is generally completely contrary to the spirit of the regulations or policy, resulting in a number of foreign investors actually breaching the law on their first entry to India. A number of such instances have occurred where foreign investors have been advised a particular course action and have suffered later; d) a lot of resources are spent by both Indian and foreign investors on the basis of an assumption (which officials encourage) only to be told at the last moment that the deal cannot go through for a vague reason. This leads to frustration and a negative impression about the country and its legal system.

The point is irrespective of whatever policy route the government chooses, it is imperative that clear regulations are made. If they are not, it seriously undermines the rule of law, by permitting the administrative authorities to misuse their discretion and more unfortunately, forcing the investors to come up with structures that are completely not in the interest of the country (and to some extent bordering on illegality).

The points I have made only reflect the tip of the iceberg. Regulation of economic activities in India is currently a mess. To some extent it is challenging for lawyers in the area as we are forced to come up with creative structures. But more often than not we also pray that these structures never ever come up in a court of law.

It is a great topic for a thesis for somebody who is interested in economic regulation.

Thanks for all of your comments on the post.

First, as regards Mr. Venkatesan’s comment on the need to go into the details of the Government’s specific objection to franchise arrangements, the following is what I can synthesize from newspaper reports. Currently, foreign investment retail trade is not permitted at all by the Foreign Investment Promotion Board (FIPB) in the multi-brand retail sector (the Wal-Mart type situation). What is permitted is only investment up to 51% in single branded retail (the Starbucks type situation). The Government is concerned that several overseas entities are circumventing the prohibition on multi-brand retail by coming in through franchise arrangements. Therefore, the Government proposes to review the entire policy on franchise arrangements. That being the case, the Government is not inclined to approve any franchise arrangements (even in the case of single-branded retailing where foreign investment itself is allowed) as it is currently reviewing the entire policy on franchise arrangements. It appears that for this reason even single-branded retail ventures like Starbucks are getting held up.

As for Arun’s points, my thoughts are as follows. At the outset, retail trade has always been a subject-matter of heated political debate, with the Left having opposed any foreign investment at all times. Therefore, politics have come to play an important role in this debate. But, I think what is required is a proper economic analysis (like what has been suggested in some of the comments to the post) on how foreign investment is in fact likely to affect kirana shop owners, or whether the fear is unjustified. Conversely, retail trade is also likely to increase the number of jobs in the economy. But, whether the benefits of foreign investment (such as increase in jobs) are likely to outweigh the hazards to local industry is a question that does not have a clear answer, and that is an area which requires proper study. By use of the expression “xenophobic”, I do not mean to single out the Indian Government’s policies in any manner. I (like Arun has expressed) too believe that even developed nations who are so-called capitalistic in their approach like the US and other European nations do not hesitate to turn protectionist when it suits them. We witnessed a lot of this occurring in the US a few years ago when there was a backlash against outsourcing to India as people there were losing jobs to development centres and call centres in India.

Another aspect that we need to consider is whether foreign investment will make the industry competitive, and in turn benefit local players. Just to look at another example, there was severe resistance in the late 1990s to opening up the financial services sector to foreign players. It was felt that foreign investment would effectively wipe out local players – predominant among them being the Government (through nationalized banks and insurance companies). However, due to India’s commitment under WTO and the general agreement on trade in services (GATS), the banking and insurance industries had to be opened up to foreign investment. The advantage of that has not only been availability of high quality service options to customers, but the fact that local players have had to step up their act to compete with foreign players thereby improving their own service standards to a large extent. Nationalised banks and insurance companies not only continue to exist today, but are still competing heavily (and quite successfully) with the foreign private players. While the above reasoning may not hold good directly in the case of retail trade as the local segment consists primarily of the unorganized sector, we also need to consider how the domestic retail industry can take steps to organize the sector further to meet foreign competition head on.

I couldn’t agree more with Harish on the need for clarity and certainty in regulations. The issue on retail trade is a classic instance of ambiguity in regulation (and its interpretation) that is keeping several players out as they would like to explore the possibility of commencing operations in India only when the regulatory regime (at least in this sector) attains certainty.

Thanks for the detailed response, Umakanth, as well as the examples you’ve set out (some of which came as news to me. They do help set out the competing policy considerations involved. This discussion brings up several important points that I hope will continue to be addressed as we widen the range of topics on the blog. Thanks again!