constitution amendments introduced to give effect to the proposed levy of Goods

& Services Tax (GST) are primarily enabling amendments conferring

concurrent legislative competence on the Parliament and State Legislatures.

This became necessary because GST takes within its sweep three different

incidences of taxation, two of which fell under List I (manufacture and

services in Entries 84 & 92 C respectively) and one under List II (sales

under Entry 54). Possibility of conflict in exercise of this concurrent

jurisdiction is avoided not by granting superiority to the Parliament but by

constituting a GST council that will ensure uniformity in all matters of GST

levy and administration. Being central levies, excise duty and service tax

always had a uniform national character. Extending this feature to sale of

goods, is, in my view, the most significant change brought about by these

amendments in the constitutional scheme.

was not without debate that the Constituent Assembly agreed on letting sales

tax remain within the domain of states. Sales tax was a provincial subject

under the Government of India Act, 1935. Some members were firmly against its

continuation in this way. The concern appeared to be the tendency of states to

over-exploit sales tax. Ramaswamy Mudaliar, for instance, said “as far as

possible, it (sales tax) should be uniform… in all the provinces. You will be

killing the goose if you go on increasing the sales tax”. Mahavir Tyagi was

most forceful in his opposition to leaving sales tax to the mercy of states.

Referring to the original purpose for which sales tax was left for the states,

he said:

“When various taxes were

enumerated in the list of provincial subjects, it was considered that the sales

tax was a sort of minor help to the provinces, for their revenues were static

and there was no chance for raising them. The provinces mostly depended on

their land revenue which is more or less fixed for a number of years.

Therefore, with the increased activities of the provincial Governments it was

thought better to give them some margin of extra revenue to balance their

budgets.

Now, Sir, they got a

little margin in the shape of this sales tax. As I see things, within a few

years, the situation is totally changed…Now, Sir, the incidence of taxation is

the heaviest in India. India had never faced even in times of war, such an incidence

of taxation as it is bearing today… Because there is no ceiling limit on this

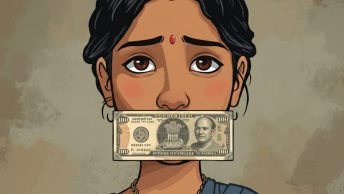

sales tax, they can go on raising the tax …My point is that if we do not fix a

limit, the provincial Governments would go on taxing, and we would be doing

sheer injustice to the people who are at our mercy and who will have no right

to protest or withhold these taxes. They would only have to draw solace from

the fact that they were after all being taxed by the persons for whom they had

voted.”[1]

comments were being made in response to Ambedkar’s tabling of draft Art 264A, which

removed inter-state sale of goods from the states’ purview. While Mahavir Tyagi

was so critical of letting local sales tax remaining within the jurisdiction of

states, Amiyo Kumar Ghosh went to the other extreme by demanding that even

inter-state sales should be taxed by the states. One member, however, suggested

something that could have been very similar to what may come to be under the

GST set-up.

Shibban Lal Saxena moved an amendment that proposed to remove restrictions on

both, the State to tax inter-state trade and the Centre to fix rates of local

sales tax; thus suggesting some sort of a concurrent jurisdiction for all forms

of sales tax. Finally, however, draft Art 264A as introduced by Ambedkar became

Art 286 of the Constitution.

Article was (then) accompanied by an explanation which lead to the Supreme

Court overruling its own view, within a span of two years, on whether the

consuming state could levy tax on sellers in other states and whether the

explanation was an exception to the prohibition against states taxing

inter-state sales.[2] The issue was set at rest by an

amendment to the Constitution and the enactment of Central Sales Tax Act, 1956

which, regulated taxation of goods moving from one state to another. The Act

ensured uniformity in such taxation.

fiscal prudence of this set up was considered by the Taxation Enquiry

Commission headed by John Mathai, which categorically ruled out the possibility

of centralizing sales tax on basis that it “had strong local moorings.” The

business community however was relentless in attacking state-centric sales tax.

FICCI presented a memorandum to the Central Government in 1960 demanding that

sales tax should be levied and collected by the Central Government and then

should be distributed among the States. This memorandum prompted the Government

to set up a committee under the chairmanship of Dr. B.C. Roy to examine the

feasibility of centralizing sales tax. But the states appeared to have

vehemently opposed not just any attempt to centralise sales tax but even the

then existing system of levying central additional excise duty in lieu of sales

tax for a few products like sugar, tobacco and textiles. Even successive

finance commissions could not ignore state autonomy. In what appears to have

been the first political move on this front, the Janata Party promised

abolition of sales tax as a part of its manifesto but could do little to take

things forward.

this position should have changed with the introduction of VAT by most state

legislatures.[3] It was quite incongruous to allow a

state-based levy when the incidence of taxation had shifted from the point of sale

to value addition in a supply chain that could stretch across multiple states. Under

State-centric VAT legislations, the fundamental benefit of VAT, which is the

removal of cascading effect of taxation, could be fully obtained only when the

chain of supply fell within the same state. Once again, opposition from states

to centralisation let this incongruous situation continue for more than decade.

GST Constitution Amendment changes the constitutional scheme to enable the

centralisation of all taxation on goods and services, while giving states a say

in the matter through the GST Council. How the states reconcile themselves to this

new constitutional arrangement will be the key to the success of GST.

are at least three problematic issues with the proposed GST. The first, of

course, will be that of separation of powers over taxation. Sec. 7 of the Model

GST law released by the Government says “There shall be levied a tax called the

Central/State Goods and Services Tax (CGST/SGST) on all intra-State supplies of

goods and/or services at the rate specified in the Schedule . . . to this Act

and collected in such manner as may be prescribed.” It is not clear from this

provision whether every supply of goods and/or services will be subject to both

Central GST and State GST or whether there will be a division of assesses

between both levies based on the natures of goods and/or services supplied or

on the basis of turnover. West Bengal, for instance, has already demanded that all dealers with a turnover limit

of less than 1.5 crores should be left for the states to tax.

will be the issue of administration. While the states almost exclusively

administered all aspects of sales tax both under CST and local law, the center

will have to ensure that its current administrative set-up adjusts itself to

tracking supplies within and across states. Coordination between the two

authorities will be crucial. After all, if the final law contemplates

concurrent assessment under central and state GSTs for the same kind of

transactions, an assesse may have to undergo the harrowing experience of facing

two assessments for the same transaction by two sets of officials with

different administrative backgrounds.

the issue of compensating states for loss of revenue by fixing a Revenue-Neutral-Rate

(RNR) of tax is likely to be very contentious.[4]

The apprehension of manufacturing states has been put pithily by a senior bureaucrat of the Tamil Nadu

government:-

“The worries of the manufacturing states

have not been addressed properly by the union government. The revenue loss

compensation assured by the union government for a specific period is a rocket

booster, but it is doubtful that the proposed GST vehicle would launch the

manufacturing states in the revenue trajectory they are travelling in now,

especially after the booster runs out. If there is a failure in this mission,

with no independent powers of taxation, such states may be left in the lurch.”

change may have attained fruition, the success of its working through statues

and regulations is likely be as daunting if not more.

were caustic, to put it mildly.

– 1953 SCR 1069 was overruled in Bengal Immunity Company Ltd Vs State of

Bihar – 1955 2 SCR 61. The decision to constitute a larger bench in Bengal

Immunity was taken only because one of the judges in United Motors (Justice

Bhagwati) claimed to have changed his view on the provision. This manner of

over-ruling precedent, unsurprisingly, attracted Seervai’s ire in his

commentary.

FRBM Act, 2003 suggested that progress towards VAT system should be preceded by

a comprehensive goods and service tax. http://finmin.nic.in/reports/5.pdf

Subramaniam Committee has not been received well by the states: http://www.livemint.com/Politics/e1x83F5GsvWQUcOgiW6kRM/States-reject-GST-rate-proposed-by-Arvind-Subramaninan-panel.html