India has become the preferred destination for multinational companies (MNCs) to outsource significant parts of their operations to be performed on Indian shores. For this purpose, the MNCs establish captive operations in India. The captive Indian entity exclusively services the parent MNC for which it gets paid appropriate fees.

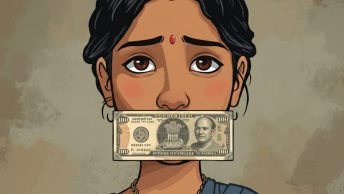

The question that was the bone of contention was whether the Indian revenue authorities can only tax the captive Indian entity for the fees that it receives from the MNC parent or whether the MNC parent (that is outside India) can itself be taxed by the Indian authorities to the extent of the income it has derived internationally from operations attributable to the captive Indian entity.

This was the subject matter of litigation before the Authority for Advance Ruling (AAR) in the Morgan Stanley Case. In February 2006, the AAR ruled that even if the captive Indian BPO operation was treated as a “permanent establishment” of the MNC, only the income received by the Indian entity from the MNC parent would be taxed in India. It also held that the MNC parent itself would not be liable to be taxed in India to the extent of profits attributable to the Indian operations so long as the Indian entity was remunerated by the MNC parent on an arm’s length basis.

With the AAR ruling being in favour of the assessee, it was naturally the subject-matter of an appeal preferred by the revenue before the Supreme Court. As reported in the Economic Times, the Supreme Court yesterday upheld the decision of the AAR and ruled in favour of the assessee.

The gist of the ruling is as follows:

(a) it is first necessary to determine whether the Indian captive BPO is a “permanent establishment” of the MNC parent. If not, then the MNC’s profits are not taxable in India;

(b) if the Indian captive BPO is determined to be a “permanent establishment”, then the MNC parent’s income (attributable to the Indian operations) will be taxable in India only if its remuneration of the captive Indian BPO is not on an arm’s length basis.

The logic of the Supreme Court decision seems to be to ensure that there is no tax leakage through outsourcing. In other words, if the transaction between the MNC parent and the Indian captive BPO is on an arm’s length basis, then the Indian entity receives sufficient revenue on which it pays taxes in India. However, if the services of the Indian entity are undervalued (and not on an arm’s length basis) resulting in less revenue to the Indian entity, that would in turn result in less taxes being paid in India and hence revenue leakage.

It is therefore important for all captive BPO entities to have proper transfer pricing arrangements with their MNC parents such that the transactions are conducted on an arm’s length basis.

It is believed that this ruling from the Supreme Court will put to rest the ambiguity that existed in the interpretation of the Income Tax Act and various circulars issued by the Central Board of Direct Taxes (CBDT). See also, SC ruling clears the air on captive BPO taxation.

Dear Umakanth,

Thanks for the post. I expected a post on this subject as soon as I read it y’day in The Hindu news updates.

Could you please explain what is meant by remuneration at an ‘arms length’ basis ?

The news reports have this phrase within quotation marks but none seem to explain it:)

Thanks Srinivasan,

Arm’s length basis means at market rates. In other words, the price which the MNC parent pays to its captive Indian BPO should be at least the price it would have paid any other third party vendor of the same services.

There are different methods of determining arm’s length pricing, which takes one into the realm of “transfer pricing”. The best way to determine if the price is at arm’s length is for companies to undertake a transfer pricing study (which most reputed accounting firms are equipped to do) and then fix the price for the services on that basis.

Am I the only one who finds the Supreme Court’s analysis confusing? It appears to me that in the first half of the judgement, regarding the PE question, the court concludes that MSCo has a service PE in India because it has sent its employees to India to assist the Indian subsidiary, MSAS, and the employees cannot be regarded as having become employees of MSAS because MSCo retains a lien on their employment. In the second half of the judgement, the court considers the question of how the profits attributable to the PE should be determined. One would expect the court to ask how much MSAS should pay MSCo for the services that MSCo’s employees are providing to MSAS in India, as that is the PE that the court found to exist in the first part of the judgement. But instead the court looks only at the service fees payable by MSCo to MSAS. Why? It is a mystery to me. MSAS is a bona fide Indian corporation providing services to MSCo on its own account. It is not a PE of MSCo, according to the court. The PE defined by the court is a PE of MSCo created by the presence of MSCo employees in India who are providing services to MSAS.

What am I missing?

The court notes in passing in the early part of the judgement that MSAS reimbursed MSCo for the salary costs of the MSCo employees in India, but otherwise never considers the question of whether MSAS was adequately remunerating MSCo for the services provided by MSCo. Surely this is the logical next step after the definition of the PE as a service PE of MSCo which is providing services to MSAS. Or perhaps the logic takes one in a circle: MSCo deputes employees to MSAS to assist MSAS in providing services to MSCo, so the question is whether MSCo is paying a large enough service fee to itself for the services it receives from itself in India; and MSAS receives this fee as a nominee or agent of MSCo’s Indian PE. Crazy.