In yesterday’s Hindu, Jairam Ramesh identifies a pressing national priority: “THE UNITED Progressive Alliance Government has embarked on major new publicly-funded programmes in employment generation, rural infrastructure, education, health, nutrition, social security for unorganised sector workers, and urban renewal. These programmes have been long overdue. Clearly, additional resources have to be found quickly.” He puts forth some suggestions for raising such resources. My focus is on his second suggestion: “A second route is through recovery of what is owed to banks and financial institutions by the corporate sector. Today, the overall level of non-performing assets (NPAs) in the entire financial system is close to Rs.1,20,000 crore. Of this, roughly Rs.50,000 crore are the NPAs on account of the corporate sector in banks and financial institutions, with the balance constituting NPAs of the priority sector in banks and NPAs in cooperative and rural banks. Even if a quarter of this is recoverable, it will make a substantial difference to public spending. Recently, Parliament has given the Government full legal powers to accelerate recovery. There will be no political dispute or controversy if this is pursued aggressively.” Clearly, the law has an important role to play in attaining this objective. However, efforts at reforming the law have not produced particularly successful results in the past. One such effort was the enactment of the Recovery of Debts Due to Banks and Financial Institutions Act, 1994 (I have always been struck by the irony inherent in the title of the Act). Generally referred to as the DRT Act, this piece of legislation has run into difficulties and is not perceived as being successful. An academic paper available online assesses the historical evolution of this Act over time, mentions the legal challenge it was subject to and how that was overcome, and also provides some details about the manner in which it has been implemented. In 2002, Parliament enacted the Securitisation of Assets and Reconstruction of Financial Assets and Enforcement of Security Act, 2002 (generally referred to as the SARFESI Act). This legislation appears to have made it easier for banks and financial institutions to act against defaulters. However, they continue to face the problem of finding effective ways to bring defaulters to the negotiating table. In the mid 1990s, the media ran several stories of how banks and financial institutions had hired toughies to act as recovery agents and there were several reports of the strong-arm tactics that were used, which often fell foul of the law. A few days ago, Sucheta Dalal wrote a column in the Indian Express focusing on how one particular company called ‘Adhikrut Jabti Evam Vasuli’ (translated, it means official seizure and recovery agency) is going about the task of recovering bad debts in an innovative manner. After analysing the website of the company, Dalal notes: “Its list of clients (including 20 top nationalised and cooperative banks) is backed by appointment and commendation letters. There is a detailed description of services offered (investigation, survey, custody, security, valuation and sale of assets etc), which is accompanied by a list of ‘duties’ and an explicit fee structure. The most interesting aspect of the website was its elaborate ‘code of conduct’ and specific guidelines to be followed in its recovery effort. As Bhatia [the head of recovery operations – a ‘college going’ woman] tells me, the key to their way of doing business is the process they follow. She has a whole checklist of tasks that precede an …. operation to embarrass a defaulter. The first step: ‘‘I research to check the ability to pay and other businesses.’’ …. Secondly, she writes to the company and asks them to pay up. When that fails an operation is planned. This involves informing the local police station and requesting that a constable accompany the recovery team. The building society is notified of the action and defaulter is also given the exact date and time when the recovery team would arrive for collection. This is aimed at providing plenty of opportunity for a person to avoid embarrassment and at least start a negotiation with the bank. As a further precaution, the actual operation is video-recorded and made available to the bank to avoid any charge of misbehaviour against the recovery team. … Another aspect of this unusual recovery firm is the sophisticated code of conduct prescribed for its employees and posted on its website. It promises ‘‘dignity and respect to customers’’ and a debt collection policy that is not ‘‘unduly coercive in collection of dues’’ but ‘‘built on courtesy, fair-treatment and persuasion’’. It also promises ‘‘fairness and transparency in repossession, valuation and realisation of security’’.” Dalal’s piece describes how the recovery agency ensured that a high profile restaurant in Mumbai paid up its dues to a prominent bank. It certainly makes for interesting reading. The website of the recovery company indicates that it has recovered a total of Rs 2274.78 lakhs over a period of 6 years.

While this approach does seem to be an improvement over the strong-arm tactics used by recovery agents in previous years, I wonder if it doesn’t tread on the boundary of actions that debt recovery agents can undertake legally. It may well be, however, that unconventional approaches may be required to attend to this pressing problem.

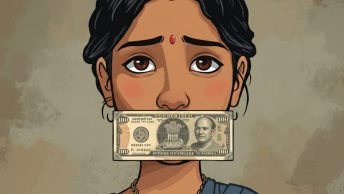

Recovery of public money is daunting task.

It is very difficult to recover money from and of :

1) From a person who does not want to pay back.

2) For the institution who has no intrest in recovery.