This post might be a bit dated, but I thought I should share Ram Jethmalani’s sensible opinion on the controvery over Nalini Chidambaram appearing for the Income Tax Department. I think it highlights some important aspects that have been generally ignored by other reports and articles on the controversy. The Asian Age link does not work well, so I’ve cut and pasted this article. I hope it constitutes “fair use.”

Goodbye to decency- By Ram Jethmalani

Decency and good manners are habitual casualties in Indian politics. Political opponents viciously attack when they see some chance of prejudicing some section of the public against the targeted enemies. Accusations without foundation merrily make headlines in the daily press. The electronic media makes the atmosphere still more murky. Often the poor victim, out of a sense of propriety, refuses to descend into the arena or fight his traducers with their own weapons.

The victim has also the uneasy experience of being cold shouldered by his friends and colleagues, some of whom even gleefully enjoy his discomfiture in the unfair encounter. This happened to Mr L.K. Advani sometime ago and recently to Mr Chidambaram. Both must have despaired of human nature and lack of gratitude.

Despite my other preoccupations I did keep my attention riveted on the progress of the Chidambaram controversy until Parliament adjourned at the conclusion of the Monsoon Session. The media had approached me many times to express my views, to secure my response or to even get a sound bite to tell them where I stood. I managed to maintain a perfect silence. I was not looking at the controversy either from the point of view of the finance minister or his detractors like my friend Sushma Swaraj and others. I was thinking of Nalini Chidambaram whom I have known for years. My gut instinct was that she could not have been guilty of anything dishonourable or even mildly improper.

There was however one handicap. I required to see the copy of the judgment of the Madras High Court at some leisure and carefully scan through it. I managed to get it sometime recently, read it thoroughly and I was glad that my initial gut reaction was astoundingly accurate. I am almost sure that not one of these politicians who were freely raining mud on the finance minister had read through the judgment and evaluated the role of senior counsel Nalini.

The judgment of the Madras High Court was delivered on April 29, 2005. The high court was disposing of the cases of numerous assessees in Tamil Nadu, who were all textile or spinning mills. The Income Tax Appellate Tribunal had come to the conclusion that expenditure incurred by these mills for replacement of worn-out machinery was of revenue character and, therefore, a legitimate deduction for the purpose of tax assessment. All appeals and references were at the instance of the department which wanted the reversal of the tribunal’s eminently reasonable holding. The first question which falls for serious consideration was: what was the state of law before the high court delivered its judgment? Out of a bunch of matters, the high court selected one typical case that related to M/s Janakiram Mills Ltd, of Rajpalayan, relating to the assessment year 1986-1987.

As usual, the assessing officer had negated the assessee’s claim but the assessee’s appeal was allowed by the commissioner of income tax (appeals), who felt bound to so decide by reason of a binding decision of the Appellate Tribunal rendered in 1984 which in turn was based on an earlier decision of the Supreme Court rendered in 1967. The reasoning of the assessee which succeeded was almost incapable of being countered.

Every textile mill is to be treated as an integrated unit and every piece of machinery involved from the beginning to the end of the manufacturing process is only a small part of it. When any part became worn out, replacing it by one which works cannot but be considered in law and in common sense as revenue expenditure. The replacement only restores the diminishing productivity of the mill inevitable as a consequence of the wear and tear of the machinery.

Moreover, the assessee had a very strong case in equity. The view favourable to him was not a novel judgment of the tribunal. The Madras High Court itself had in several judgments rendered by it, arrived at the same conclusion of law. The decisions of the Madras High Court were so good and invulnerable that the department had not found it worthwhile to test their validity in the Supreme Court. In view of this fact the department was faced with another serious obstacle. The Supreme Court had naturally held more than once that appeals cannot be filed in the case of some assessees when they have never been filed in the case of other assessees. This would be hostile discrimination against some citizens and the courts will not encourage what would be a breach of the Constitution.

In addition to all this the assessees had led the evidence of an expert body, the South India Textile Research Association, which two years earlier in a written report had certified that all the eight steps in the manufacturing process in a spinning mill are interlinked and that the output from the various intermediate stages of production cannot be sold or marketed and used for other purposes. Every spinning mill should therefore be considered as a single integrated plant. The assessee’s case and this expert’s report found full support from a large number of judicial decisions going back at least 25-30 years. There had been almost no dissenting opinion.

The department knew that it had a bad indefensible case. No wonder they tried to find a new counsel and I am not surprised that their choice fell upon Nalini Chidambaram, not because she was P. Chidambaram’s wife, not because this would weigh with the judges of the high court, not because she was a brief-less lawyer who needed some financial help, but because she was adjudged as an able lawyer who might by some ingenious arguments achieve the impossible in the difficult forensic battle.

She was available for a reasonable fee and the bunch of textile-spinning mills which were parties to the litigation did not include one in which either her son or her brother-in-law had any particular interest. I have never heard it said by anyone except a complete ignoramus or one who maliciously indulges in character assassination that a senior lawyer is under some obligation while accepting a brief to make an exploratory study whether the judgment in the case might possibly confer some day some benefit on a friend or relative.

I have carefully gone through the judgment, particularly Nalini’s submissions in this difficult case. She made a brilliant attempt to distinguish all the cases upholding the unified integrity of the mills on the ground that in 1989 there has been a change in the statutory law which knocked out the rationale of those cases. It was an ingenious argument, though I am not surprised that it did not cut ice with the high court. She then tried to argue that in earlier cases no appeals have been filed because the financial stake involved was too small to merit the expenses of a Supreme Court appeal.

If the Madras High Court decided in favour of the assessees it did so because the assessees had a formidable case and no lawyer of the department could have demolished it. Nalini had not solicited the brief, she was persuaded to accept it. Her husband had no hand in securing it for her. The emoluments were less than the value of the labour involved.

The mud slinging against the finance minister and indirectly against Nalini is thus irresponsible if not malicious. The finance minister has gone on record before Parliament that he did not know of his wife’s engagement, otherwise he would have nipped it in the bud. This statement has been corroborated by those who took the decision to engage Nalini in the case. At least the anti-Chidambaram campaign should have stopped there but truth seems to be irrelevant in many current political controversies.

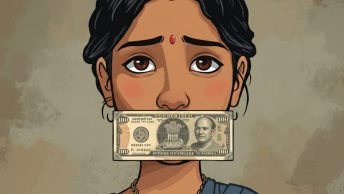

I have however a bone to pick with the finance minister. A wife is no longer subject to the tutelage of her husband. Nalini is an independent professional and if her husband tries to interfere with her professional engagements and earnings she might justifiably tell her husband “get lost.” Instead, she meekly returned her fees. I hope the department will have sense not to take back the money. I, for ever, would stand for the dignity and autonomy of the female professional. Even the finance minister and his department are bound to respect these.