Introduction

The Supreme Court of India, through its 9-judge bench finally untied the knots of the oldest pending case before such a bench. The case, Mineral Area Development Authority v. Steel Authority of India Ltd (MADA), has been pending since 2005. The matter was transferred to a 9-judge bench by a 5-judge bench in State of West Bengal v. Kesoram Industries Ltd. (Kesoram) to revisit the decision in India Cements v. State of Tamil Nadu (India Cements) which held that royalty is a tax. The MADA verdict effectively overrules the longstanding precedent set by the 7-judge bench in India Cements by holding that royalty is not a tax and hence, the state could levy cess on royalty.

On 14 August 2024, the Supreme Court (August order) specifically dealt with the question of ‘from when can they be taxed’. This issue was marred with inconsistencies between the opinions of state authorities such as Odisha, and that of the Centre. The Supreme Court has ordered that the MADA verdict shall have a retrospective effect from 1 April 2005 till 25 July 2024. Further, the August order states that it is the states’ prerogative whether to tax retrospectively or not ensuring a necessary flexibility for the states to operate. Nevertheless, different states will have different approaches, ultimately leading to differences in subsequent costs of such minerals due to the levy or non-levy of retrospective taxes.

In this blog, the author shall delve into the economic implications and the dilemma of preserving social security in this case, and then examine the superiority of doctrine of prospective overruling as contemplated in Golaknath v. State of Punjab (Golaknath) along with its roots in the American jurisprudence.

Deconstructing The Rationale Behind Retrospective Application

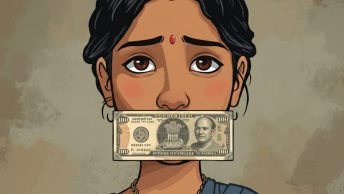

It is important to understand the rationale behind retrospective application of the verdict. An understanding of the August order gives a glimpse of the entire debate, that is, between economic impacts on common man (one who purchases the final goods) and social security of marginalised communities (indirectly through revenue of that state) residing in mineral rich areas. It is important to note that mineral rich areas, specifically in Odisha, have a substantial population of marginalised communities who depend on the state for their wellbeing.

Economic Implications v/s Social Security

The burden of costs on the shoulders of the mineral corporations would be substantial, over three times their own net worth. There is some respite through the laying down of a 12-year period in which the costs would have to be paid in instalments. Nevertheless, the costs of mineral would increase through two-fold additions—(1) pending costs payable from 2005 to 2024; and (2) levy of cess on top of royalty after 25 July 2024 by virtue of this verdict.

Ultimately, the increase in costs of minerals would have a multi-polar and multi-fold effect in the economy. As the Attorney General highlighted, such a regime would have a multi-polar effect since minerals serve as raw materials to several industries and the costs of various products across different industries would bear the brunt. The multi-fold effect would take place by virtue of the burden of such costs shifting from different stages of economy and would ultimately be borne by the final consumers of the goods, that is, the common masses. While there is more complex economics at play which may not lead to a proportionate increase in cost, it is likely that there is a noticeable increase in prices due to the increased cost of procuring raw materials.

Contrarily, Odisha contended that there would be a significant loss of revenue of the state if the judgement is applied prospectively since the actions of the state during the period of 2005 to 2024 would be subject to India Cements, meaning that it would have to refund all the taxes charged on the royalty in the form of cess. This would starve the already depleted state treasury and would badly affect the people, particularly the marginalised communities in those areas.

At this juncture, the author posits the possibility that such retrospective application does more harm than good. For instance, the same marginalised individuals will be impacted adversely by such retrospective application as they would be ‘final consumers’ for certain goods whose prices would be hiked due to the cascading effects of price rise of raw materials from the retrospective application of MADA verdict which were not offset by government subsidies and other such initiatives.

Doctrine of Prospective Overruling

The solution to this dilemma of application of the verdict lies in a more flexible application of the Doctrine of Prospective Overruling (doctrine). India traces this doctrine from the case of Golaknath. Although Golaknath has since been overruled, the principles of the doctrine are still considered to be of great importance by the Supreme Court.

The doctrine aims to ensure that a verdict results in a just and fair impact on the affected parties, without adversely affecting the transactions that have already taken place when a particular ruling was not present. It primarily abides by the doctrine of quieta non movere or ‘do not disturb what is already settled.’ This doctrine is particularly applicable when some legislation is annulled or a new interpretation of law is created. Hence, the argument against the application of doctrine of prospective overruling is that in the MADA case, the verdict merely resurrects old laws providing for ‘cess on royalty’ that were earlier deemed unconstitutional due to the India Cements, and there is no new law created or old law annulled. However, the author contends that the purview of the doctrine extends beyond such frontiers and it is essential to take the impact of the verdict into consideration to examine the question of application of the doctrine.

It is in this context that the author argues that there is a need to rethink the applicability of the August order on MADA. A flexible application of doctrine of prospective overruling would be a welcome move. This could be done by adding ‘no refunds, no demands’ clause to the prospective application ensuring that the verdict applies prospectively but there could be no claims from either side with respect to the period between Kesoram and MADA. Such an application of the MADA verdict would provide equal benefits to all parties—the Union Government and Mining Companies would benefit from not having to pay the humongous tax burdens due to prospective effect while the state governments would benefit from the flexible application since they would not have to refund the tax collected from the time period between Kesoram and MADA.

Counter-Arguments

While it is assumed that states would lose out on the opportunity to restore the past benefits because the doctrine fails to ‘right’ past actions, I would rebut such an assumption through a two-pronged argument.

Firstly, Justice Cardozo in Great Northern Ry. Co. v. Sunburst Oil & Refining Co., notes how ‘there was no basic injustice done in a court at its discretion acknowledging the existence of a right and at the same time refusing to apply it to past transactions’. Hence, for legal consistency, the MADA verdict must not aim to right the ‘past’ actions by jeopardising the future due to its retrospective application. The more pragmatic approach would be to align with ‘certainty’ of law such that the future of the mining industry and by virtue of that, of other allied industries and dependencies, is not compromised.

Secondly, the applicability of theory of Second Actor, as contemplated by Dr. Christopher Forsyth, which states that when an action by one party is influenced by a preceding action or ruling, the second actor should not disproportionately bear the burden of the initial actor’s choices. In this case, the state governments’ reliance on the now-overruled precedent (India Cements) created expectations and revenue systems that now shift the burden of correction onto mineral corporations and, ultimately, consumers. Therefore, the court must balance the application of the verdict with the impact that it may create on the future of this industry by uprooting the past history. The doctrine is applied to ensure a smooth transition during changes in the operation of law without adversely affecting the rights of the people who acted upon the overruled law.

As per the MADA verdict, states will be allowed to levy cess on royalty, and hence, there is no question of state being deprived of its right to collect such taxes. The author simply argues that its applicability being ‘prospective’ makes it simpler for both the state and affected companies.

Conclusion

The Supreme Court, through its verdict in MADA, has overruled a precedent. Now, the application of the verdict determines the fate of the high-stake matter at hand. The retrospective application of the verdict, even with the offsets, would significantly burden the mining industry. The alternative for the conundrum of ‘when can they tax’ can be a more flexible application of the doctrine of prospective overruling that incorporated the feature of ‘no refunds, no demand’.

Nachiketa Narain is a second-year law student at Rajiv Gandhi National University of Law, Patiala.

[Ed. Note: This piece was edited by Saranya Ravindran and published by Baibhav Mishra from the technical team of the Student Editorial Team.]

8d6h1j

mo2dru