An oft-repeated adage in the financial markets goes, “when America sneezes, the rest of the world catches a cold”. This element of financial contagion stands out starkly in the US subprime crisis that has affected markets worldwide, and as a result hogged financial media limelight for over two months now.

A simple and reader-friendly explanation of what the crisis is all about is contained in an article titled The ABC of CDOs and the Subprime Crisis by Vinod Kothari and Rochak Agarwal that appeared in the Business Standard a few weeks ago. In a nutshell, the crisis emanated with several banks and institutions in the US lending to borrowers whose creditworthiness was suspect (a.k.a subprime borrowers). The loans were provided against mortgages of their homes. It now appears that these institutions were lax in their lending processes – primarily because it was believed that growing housing prices would leave them with valuable collateral for their loans, and hence they would always be protected against default. These banks and institutions obtained funding for providing these loans by securitizing the mortgages and repackaging them into synthetic derivative securities called CDOs (collateralised debt obligations) that were sold to investors worldwide. Banks, financial institutions, investors such as hedge funds, private equity funds and even pension funds were left holding these securities. These securities indirectly assumed the risk on the mortgages.

Contrary to the expectations of the financiers, the US housing markets began declining in early 2007, and the subprime borrowers started defaulting on their loans en masse. The pinch was felt not by the banks and institutions that had lent the loans in the first place, but by the investors who had purchased securities such as CDOs whose risks and returns were correlated to the mortgages. Therefore, what started as a localized problem in certain US states (and even neighboourhoods) spread steadfastly around the world as it was found that the CDOs were held by investors across America, Europe, Asia and Australia – just to name a few, two hedge funds floated by Bear Stearns (that have now filed for bankruptcy), Basis Capital (an Australian hedge fund that has folded up as a result), banks in the UK, Germany, France, Singapore and China, and several other investors whose identities and losses may not yet be known. This event has caused a major credit crunch in the financial markets and a crash in all major stock markets resulting in billions of dollars in losses to investors.

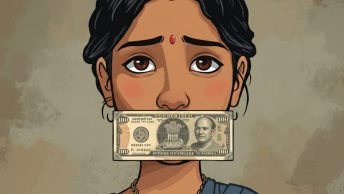

What are the implications for India? At first sight, it appears from media reports that none of the Indian banks or financial institutions has taken an exposure through investment in securities relatable to the US subprime markets. However, tangential impact there has been indeed. Foreign investors who had exposures to the US subprime markets have had to liquidate their positions in emerging markets like India to stave off crises overseas. This has led to volatility in the Indian stock markets.

There are lessons to be learned from this episode (that does not seem quite over yet as many pundits predict that the current crisis – or as much as is known of it – is just the tip of the iceberg). Although the Indian financial markets have steered clear of the crisis, there is no room for complacency. Increasing integration of the global markets and crises such as the US subprime markets are indication of the fact that problems emerging in one part of the world can strike the other corners too. Further, with growing sophistication of market players in the use of complex instruments such as CDOs and other derivatives, there is enhanced investor and market risk. Therefore, Indian regulators, primarily the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) need to work on adopting a clear policy stance towards dealing with such financial crises well before they strike so that the Indian markets and investors are protected from market contagion.

hey that was a really good article. made the sub prime crisis easy to understand.

this article realy make sence and give a good bird eye view of the topic