We are pleased to bring you a guest post by Dhruva Gandhi, Sarangan Rajeshkumar and Shubham Jain, all of whom are II year BALLB (Hons.) students at NLS, Bangalore. The authors may be contacted at shubhamjain@nls.ac.in.

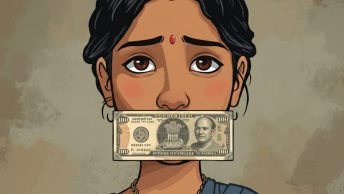

The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement (Amendment) Ordinance, 2014 has been a source of stiff resistance for the incumbent Union Government. Unfortunately, amidst the din both the problems with respect to land acquisition as well as the probable solutions to the same have received scant attention. Therefore, it is essential that we move beyond a criticism of the Ordinance and delve upon these issues.

Inadequate Compensation has now become synonymous with Land Acquisition in India. It has been a major cause for litigation and agitation. To appreciate this assertion better, let us have a look at some facts. In a study, ‘Inefficiency and Abuse of Land Acquisition in India’, conducted by Prof. Ram Singh, it was revealed that in 86% of the litigation on compensation with respect to Land Acquisition in India, the compensation awarded by the High Court (Punjab & Haryana, for the purposes of the study) was found to be close to 300% higher (on an average) than that awarded by the District Collectors. In fact, the study also mentions instances where the compensation awarded by the courts has been an increase of 800%.

The difference in compensation awarded by the Court and the Collector can be traced to the difference in the determination of the market value of the land. A preliminary look, therefore, at market value is essential. Ideally, market value or

true value of a said piece of land must be determined based on the special characteristics (eg: quality of soil, quantum of natural resources, nature of assets constructed etc.) of the land, the price prevalent in the locality and the potential use of the land. However, in light of the poorly maintained land records, steep rates of stamp duty and a widespread black market, market value of land cannot be determined accurately. This is especially true for rural areas. Therefore, the same is decided on the basis of either the circle rates (minimum rates defined by state governments at which property can be bought or

sold:

here and

here) or the sale deeds of similar properties in the vicinity. Neither of the two are accurate parameters.

Whereas circle rates are significantly under-valued, sale prices, though higher, are usually affected by features peculiar to the land, dearth of transactions in agricultural land and are suppressed to evade stamp duty (Nonetheless, circle rates are a better reflection). In fact, the Parliamentary Standing Committee on Rural Development, too, in its

examination of the Land Acquisition Bill highlighted the above mentioned points. Moreover, a study conducted by the Thought Arbitrage Research Institute in collaboration with the Ministry of Rural Development and the German Development Agency analysed 7 lakh land transactions over three decades to conclude that the above mentioned

special characteristics were absent in the calculation of circle rates. Circle rates, thereby, grossly undervalued the land. It is perplexing to note that the government still decided to go ahead with these faulty methods to determine compensation. Let us now move to the main issue.

In spite of directions by courts to the contrary, Collectors seek to avoid the cumbersome process of determination of the sale deed that may closely reflect the value of the land to be acquired (apt sale deed) and compute the said value on the basis of circle rates instead of market rates (FAQ by Jairam Ramesh on The Land Bill,

here). In other words, they seek to play it safe. An intervention by the Court, then, is a natural outcome in the event of the price in the apt sale deed being higher. Every compensation amount is based on the market value of the land. Logically, thereby, to address the problem of litigation, one needs to look at the concern with respect to the market value of the land.

Contrary to popular perception, the Land Acquisition Act, 2013 allows for the erstwhile scheme under the

Land Acquisition Act, 1894 to continue for three reasons. Firstly, the Collector is vested with discretion to choose between prices as mentioned in the sale deeds or the circle rates, whichever is higher. However, secondly, he may choose to disregard any price paid that may appear to him to be non-indicative of the actual prevailing market value. (Explanation 4, Section 26). And thirdly, the Collector is barred from the consideration of compensation awards

provided for other lands acquired in the same district. The practical implication of these three provisions is that the Collector can continue to

assess market value at circle rates and to disregard prices paid for land with similar characteristics and features in the vicinity. Even now he does not need to take the trouble to determine the appropriate sale price. The problem of market value remains unsolved.

Frequently, it is argued that the solution to the problem of inadequate compensation has been found in the multiplier mechanism. The multiplier is a factor from 1-2 by which the sum of the market value and the solatium (compensation for injured feelings) must be multiplied to arrive at a compensation award. The numerical factor is to be decided by the State Government. Haryana, for instance, has fixed the multiplier for rural areas at 2. It is here that an element of caution is required. Unlike common beliefs, the multiplier may just aggravate the issue.

An illustration helps explain the same. Suppose, the circle rate in a district for a unit of land is Rs. 500 and the price as mentioned in a sale deed for a similar property in the vicinity is Rs. 750. Before the new law came into existence, the compensation not paid to the claimant would have been the difference between these two amounts with the difference multiplied by a factor of 1.3 i.e. 1+30% (Solatium was fixed at 30% under the old law). In other words, the compensation lost out was Rs. 325 [{Rs. 750- Rs. 500}*{1.3} = Rs. 325]. However, with the new law in force, the compensation lost out is the difference between the two amounts multiplied by a factor of 4 i.e. (1+100%)*2 instead of 1.3 (Solatium is 100% under the new law and the multiplier has been assumed to be 2). In other words, Rs. 1,000. [{Rs. 750- Rs. 500}*{4} = Rs. 1,000] Why, now, would an owner who took recourse to litigation to recover Rs. 325 not take recourse to it to recover Rs. 1,000? Why would this especially not be the case when Rs. 1,000 is a statutory entitlement? Courts cannot choose not to enforce a statutory right. How, then, does the new law mitigate litigation? How have judicial delays been reduced? How has the issue of “market value” been addressed? How has compensation been addressed? May the new law not increase litigation?

It is a disappointment that the Ordinance does not address any of the questions posed above. Compensation that neither compels nor incentivises litigation has not been the objective of the Ordinance. Compensation could have been addressed through better means of

assessment of market values of land (eg: independent surveyors) or innovative schemes such as auctions of the requisite land (

here) or non-monetary measures. Independent Surveyors, for instance, suitably qualified in this regard may be appointed to scientifically compute the worth

of the land (India could indeed draw from the practices prevalent in the

United States). Likewise, a

non-monetary measure of compensation that may be used when land is acquired for non-state purposes is to allot a share either in the newly developed land or the project as the case maybe.

(The current law has a similar scheme only for urbanisation projects).

In the absence of such measures being incorporated, the Ordinance, then, allows for the continuation of the legacy of the 1894 Act.

ps: The litigation that may arise out of market value and compensation may, only be the tip of the iceberg. In view of the comprehensive scheme of Resettlement and Rehabilitation (R&R) provided under Schedules 2 and 3 read with Sections 31, 32 and 38(1) of the Land Acquisition Act, 2013, a failure on part of the collector to provide for any of the varied entitlements of the displaced, may prove to be a significant source of litigation. In fact, barring a few exceptions, R&R has always been ineffective and unsuccessful. Two recent examples of the same have been witnessed in the states of Odisha and Andhra Pradesh (Report Nos.

7 &

21 of 2014 of the CAG). In light of the above, the provision of a statutory right of R&R may increase litigation even further, unless the current state of affairs was to improve dramatically.)

pps: This blog has dealt with several issues of land acquisition in the past. For previous posts, see

here,

here,

here and

here