Simon Johnson’s NY Times column on Friday claimed that during the recent G-20 meeting a deal was struck by the United States with the Europeans that the next IMF chief would not come from Europe, as is the tradition, but in an open and competitive manner. Johnson interprets this as code that the next director will come from an emerging power like Brazil or India. Johnson should be in a position to know as he was recently the Chief Economist at the IMF.

Johnson goes on to write that the United States is also going to open up the selection process for the next President of the World Bank. If true, these changes could mark the beginning of a rather dramatic shift in our institutions of global economic governance. Now, much of this could be interpreted as window dressing, as I think some of the motivation in this proposal is to restore credibility and political legitimacy in these institutions at a time when they (or something like them) are seen as needed to face the financial crisis without changing (or changing too much) the disproportionate voting power Europe and the United States retains within them. Still, this change would be beyond symbolic. These new chiefs would have a lot of power individually and their presence would add greater weight to and an insider advocate for broader reforms.

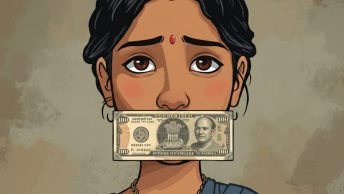

In the wake of the financial crisis, there is a clear opportunity for these institutions to be remade in the next couple years. However, countries like India, and perhaps even more importantly civil society and academics within them, need a clear vision of what they want these institutions to look like and how they will function in the future. So far, I haven’t heard much on this front in India – although admittedly this isn’t my field and I would appreciate anyone who could point me/us towards useful links.

For those interested Simon Johnson is part of a blog, the Baseline Scenario, that has a number of good posts on the recent financial crisis (albeit from an American perspective).