Much has already been stated in the press about the current financial crisis that had rocked not only the U.S. economy, but also the global financial system, and indeed the magnitude of this crisis will ensure that a lot more will be said in the future. Here we focus on one aspect of the crisis, which is the perceptible failure of corporate governance involving large companies.

In a provocatively titled book The End of History and the Last Man, Francis Fukuyama argues that the advent of Western liberal democracy may signal the end point of mankind’s ideological evolution and the final form of human government. But, of immediate interest to us is a debate in corporate governance that takes a leaf out of Fukuyama’s book (or at least its title to begin with). In an article, The End of History for Corporate Law, two leading U.S. corporate law professors, Hansmann and Kraakman set the framework for the current global corporate governance debate, where their argument is twofold: (1) American corporate governance has reached an optimally efficient endpoint by adopting the shareholder primacy and dispersed shareholding corporate model, and (2) the rest of the world will inevitably follow, resulting in a convergence of corporate governance around the world on the lines of the U.S. model. Although these arguments have been subject to a fair amount of criticism, events that have occurred over the last few days severely expose chinks in the U.S. model of corporate governance, and provide at least some anecdotal evidence that such model is questionable.

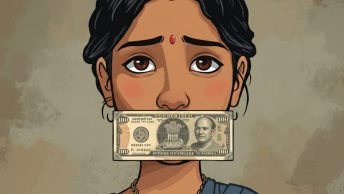

The question that is being posed is: where was corporate governance when the CEOs and boards of directors of large and admired U.S. corporations such as Bear Stearns, Lehman Brothers, Freddie Mac, Fannie Mae, Merrill Lynch and AIG saw the performance of their companies plummet, which finally resulted in a massive erosion of value to their shareholders and other stakeholders? Going back into (recent) history, this is indeed not the first time that such questions have been posed. Earlier at the turn of this century, we saw the very same questions being asked when a governance crisis of a slightly different nature occurred with Enron, WorldCom, Tyco and other companies being mired in accounting scandals.

Following this, stern legislative measures were introduced in the U.S. in the form of the Sarbanes-Oxley Act of 2002 that required companies listed in the U.S. to put in place strong systems and practices to enhance corporate governance. However, those measures apparently have been insufficient to deal with the current crisis.

Nell Minow, an influential corporate governance activist and commentator has this to say in a column on the CNN website:

“Despite the post-Enron adoption of the most extensive protections since the New Deal, a survey released this week by Kroll and the Economist Intelligence Unit found that corporate fraud rose 22 percent since last year.

The option back-dating and sub-prime messes show that even the post-Enron Sarbanes-Oxley reform law and expanded enforcement and oversight cannot eliminate the severest threats to our markets and our economy.

This proves that there are limits to structural solutions. Ultimately, markets are smarter and more efficient than regulation. What the government needs to do now is insist on removing obstacles to the efficient operation of market oversight.”

That being said, it must be noted that the Enron cohort of scandals involved some element of fraudulent conduct on the part of the actors involved (that included both insiders such as the board and managers as well as outside gatekeepers such as auditors), while in the current situation there has been no such allegation or finding yet, with the situation arising mostly from misjudgments in valuing complex financial instruments and transactions that these companies either invested in or became involved with.