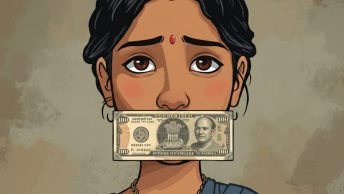

For a Mess of Potage: Has GST made States Sacrifice Fiscal Autonomy on the Promise of Increased Tax Revenue?

Guest post by Alok Prasanna

With Parliament having passed the Constitution (101st Amendment) Act, 2016 the framework has been set for the introduction of the Goods and Services Tax in India. While the Act is yet to be ratified by at least half the State Legislative Assemblies as required by the Constitution, given the widespread support it enjoyed across political parties, this should be a mere formality.

While the discourse has largely been focused on the potential economic benefits of the GST, there are serious constitutional concerns in the Amendment Act which could derail the whole exercise. Specifically, the GST Council, which effectively gives the Union a veto over the fiscal policies of the States could be challenged as being against the basic structure of the constitution. I have explored this very briefly in the two pieces linked below, but a more detailed piece for a journal is in the works.

1. In Vidhi’s Briefing Book, released last in 2015, titled “Cooperative Federalism: From Rhetoric to Reality” I have a piece (page 25) discussing the main flaws of the GST Council and dispute resolution mechanism and how they may be remedied.

2. In Bloomberg Quint, I have argued that the veto given to the Union Government in the GST Council institutionalizes mistrust between Union and States.

Subscribe

Login

0 Comments