The theme for the January 2009 issue of Halsbury’s Law Monthly is Foreign Direct Investment (FDI) and Globalisation. The issue carries two articles that generally deal with FDI and three that specifically discuss issues on Indian policy.

The first, an article titled “Globalisation and Foreign Direct Investment: Topical Issues and Case Studies” by Dr. Linda S. Spedding sets out some general principles governing FDI and also discusses the role of transnational corporations in improving risk management and governance. The article also covers the importance of linkages between globalisation and sustainable development.

In “Capturing Opportunity and Controlling Legal Risk : India’s US-Bound Deals in Challenging Times”, David Laverty outlines the legal landscape in the US that applies to Indian companies investing there. Laverty observes that, unlike India, the US does not have a detailed set of systems dealing with foreign investment notification and approvals, but that “there are still restrictions that apply in the US, but these are less common for acquisitions of private companies that are not engaged in defense or national security related activities”.

The three remaining articles discuss specific matters involving FDI in India:

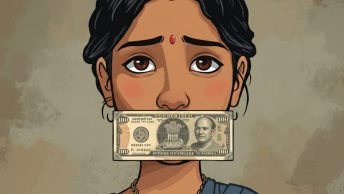

1. The cover story “FDI and Globalisation” by Dara P. Mehta outlines the significant changes in economic policy that were effected in 1991 when the Indian economy was opened up to foreign investment. That represents a radical approach as the Indian economy had followed protectionist policies for several decades until then. Although this has resulted in economic development and growth since the early 1990s, Mehta outlines a series of issues involving FDI that continue to act as a bottleneck towards attracting further FDI. The first is a general issue that signals that a robust legal set up for FDI that is yet to fully evolve. The article notes:

“The Legal Framework to Regulate FDI Ideally, a complex subject like FDI should be regulated by a single agency of the Government, acting under the authority of the same statute or of rules and regulations, properly framed under that statute. Unfortunately in India, this subject is administered by several agencies, some of whose function overlap each other. To make things worse, matters relating to policy are announced and reviewed by at least two agencies of the Government of India, the Department of Industrial Policy and Promotion (“DIPP”) whose executive arm is the Secretariat for Industrial Assistance (“SIA”) and by the Foreign Investment Promotion Board (“FIPB”). Statutory regulation is effected by the Foreign Exchange Management Act 1999 (“FEMA”) and by the rules and regulations made thereunder. But, very often, the non-statutory policy measures that are announced by the SIA in the form of the so called Press Notes conflict or are inconsistent with some of the regulations and regulations issued under FEMA. Policy measures that are announced by these Press Notes are non-justiciable, whereas the decisions of the Reserve Bank of India made under FEMA or under any of the rules or regulations made under FEMA can in appropriate case be made subject to judicial review. These multi-level agencies of administration of FDI cause bewilderment and confusion to foreign investors and certainly do not promote the cause of the globalisation of FDI. Moreover, the bureaucracy considers that these press notes are equivalent to a rule or notification issued under a statute and regards them to be as immutable as the laws of the Medes and Persians!”

Mehta then goes on to deal with certain specific issues such as (i) Press Note 1 of 2005 (that prevents foreign investors who had previous ventures in India from availing of the automatic route for further investments); and (ii) downstream investments by “foreign owned holding companies”, which present significant obstacles to foreign investment. In the case of Press Note 1 above, it is the strict rules laid down by the Government that pose an issue, while in the case of downstream investments it is a difficult (and somewhat far-fetched) interpretation adopted by the bureaucracy that causes problems. These are technical matters involving specific regulations, and the interested reader may refer to the article for further details.

2. In “Recent FDI Dampeners”, Atul Dua and Amit Mehta paint the issues with a broader brush. Apart from interpretation of the FDI regulations discussed by Dara Mehta above, they argue that certain recent decisions by Indian courts and tribunals on taxation matters will prove to be a dampener for further FDI. In particular, they refer to the decision of the Bombay High Court in the Vodafone case and that of the Authority for Advance Rulings (AAR) in the Fosters case. In both these cases, income earned by foreign investors was held to be taxable in India although the income was arguably earned and received outside India. The basic message is that the long arm of the Indian tax man is a cause for concern for foreign investors.

3. Amid this mood of pessimism comes a more sanguine outlook in Ramni Taneja’s article “Judicial Perspectives Regarding Foreign Direct Investment and Globalisation”. Ramni points to various decisions of Indian courts that have usually refrained from interfering on matters of economic policy. She concludes that the “Indian judiciary has in its judgments consistently preserved as unassailable the economic and industrial policy of the Government of India, and its natural concomitant, i.e. the FDI policy”. But, note that this assessment is confined only to the FDI policy, and does not deal with taxation matters which present the opposite position as discussed by Atul Dua and Amit Mehta above.

Overall, the timing of this topic for Halsbury’s Law Monthly is interesting. Governments all over the world (let alone India) are busy working on economic packages to boost development and employment, in order to overcome the economic slowdown and crisis. FDI forms an important part of this package. India too has consistently been taking measures to boost FDI, slowly but steadily, through a cautious approach. In that context, it is useful to pause and assess matters of legal policy and interpretation regarding FDI, as Halsbury’s Law Monthly has done. The take away from this discussion is that there is a need for greater certainty on the FDI policy – that ought to come from clearer policies written by the Government and appropriate (and purposive) interpretation of these policies in their working by the bureaucracy

Its a wonderful perspective on what deserves to be done at the Executive level of the Government of India. However, recessionary trends emerging in several parts of the world will likely ensure that investors will not take time to thank policy reforms at this hour.