Earlier this week, the World Bank and its investment arm, the International Finance Corporation, published the Doing Business Report 2008 that ranks 178 countries in the world, providing an objective measure of business regulations and their enforcement across those countries. This year, India ranks 120 out of 178 countries, which is 12 notches above its previous year’s ranking of 132. The Report also summarises India’s position (here) on the basis of various parameters. However, there is no cause for celebration as India ranks far below several other emerging economies in providing a legal and regulatory framework that facilitates business and commerce.

As for the good news, the report throws positive light on India’s improvement on two counts, viz. (i) reduction in the number of days taken for export – from 27 days to 18 days (improving India’s ranking on the parameter of cross-border trading from 142 to 79); and (ii) access to credit (where India’s ranking improved from a ranking of 62 to 36). On all other parameters, India’s rankings have either remained the same or deteriorated from the previous year.

One aspect that is worthy of note is India’s high performance in the area of protecting investors, where India is ranked at 33 (previous ranking of 32). This is thanks to a robust company law regime coupled with a widely-expanding corporate governance and disclosure regime that has been put in place by the Securities and Exchange Board of India (SEBI) over the last few years.

On a Chindia comparison (which is becoming increasingly inevitable these days!), India has fared marginally better than China in moving up 12 notches from the previous year compared to China’s climb of 9 notches. But, on absolute terms, China is ranked at 83 compared to India’s 120. India’s performance among other emerging economies is generally lackluster, though it is somewhat comparable with the two other BRIC economies, Brazil (at 122) and Russia (at 106).

Reports such as this offer impetus for introspection. The Government itself cites the Doing Business Report while contemplating economic reforms in various sectors. Once again, we need to revisit some of the issues that are responsible for India’s current ranking in the world economy.

First, there are the regulatory hurdles. Several aspects of doing business in India require multiple procedures to be complied with. There are multiple agencies involved in administering different regulations. Often, there is duplication involved – firms are required to file the same information (or variants of the same information) with different authorities who often act at cross-purposes. What is required therefore is proper streamlining of procedures for carrying on business in India – reduction in the number of procedures as well as number of authorities involved. Further, there is a need for proper coordination among authorities.

Second comes bureaucratic delays. Applications for approvals or licences take inordinately long due to delays in decision-making by the governmental authorities. This frustrates businesses and causes valuable time and opportunity losses. There is a dire need for cutting down time frames for governmental decision-making.

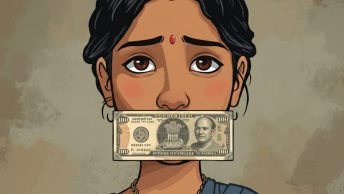

Third is the lack of transparency is decision-making. Often, little or no reasons are provided for delays or rejections in the governmental approval and licensing system. Such opacity is also the cause for corruption at several echelons of the governmental machinery, that in and of itself is another cause for obstructing ease of business activity in India.

Fourth is problems with enforcement. Although India does have robust substantive laws in various spheres (that have withstood the test of time – Contract Act being one example) there is much left to be desired in the enforcement of these laws. The primary problem is in lack of capacity within the judicial system to absorb enforcement tasks and perform them satisfactorily. The court systems are overburdened with so many pressing issues and are unable to cope with the caseload. It is disheartening to note India ranks at 177 for contract enforcement (only above Timor-Leste) and it takes 1,420 days on an average for a successful party to recover on a contract suit.

It is therefore obvious that the continuing reforms need to address all these issues in a timely manner.