That was the theme for a panel discussion organized earlier this month in New York by the Jindal Global Law School. The panel consisted of internationally renowned academics and practitioners of corporate governance: Mr. Roel Campos, former SEC Commissioner, Professor John Coffee of Columbia Law School, Professor Michael Useem of the Wharton Business School and Professor Vikramaditya Khanna of Michigan Law School. I enjoyed the distinct privilege of moderating this panel. This was the first of a two-part series of panels put together by the Jindal School, with the second, a full-day conference to be held in New Delhi on February 23, 2009 that will include among other speakers, the Law Minister and Commerce Minister of India.

The goal of this panel was to consider reforms arising out of the Satyam episode as well as other occurrences globally. While a number of interesting thoughts emanated during the discussions, I will attempt to summarize some of the key outcomes in terms of recommendations below:

Taxonomy

It is important to lay out the taxonomy of corporate frauds and governance failures. In jurisdictions such as the US and UK, managers (such as the CEO, CFO and other senior executives) are compensated through stock options and equity and hence there is a strong incentive to inflate earnings. On the other hand, in countries such as India where there is concentrated shareholding, the critical actor is not the senior management but the controlling shareholder (a.k.a. the promoter). In such a scenario, where fraud is involved, it usually does not result in an inflation of earnings, but in related party transactions whereby assets of a company are siphoned out to other companies owned by the controlling shareholder. In that sense, and in drawing international parallels, although the media has called Satyam “India’s Enron”, this case is more akin to the Parmalat case which also involved affiliated transactions and misstatement of financials. The regulatory response in terms of reforms will have to take into account the differences in the systems where diffused shareholding is the norm (US and UK) and where concentrated shareholding is the norm (e.g. India).

Audit Process

There is clearly a case for reforms in the audit system.

– The appointment of auditors ought to be shifted from the purview of the controlling shareholders to the independent audit committee so that auditors do not owe any allegiance whatsoever to the controlling shareholders, and that the process of appointment and removal of auditors is effected in a manner that is truly independent of controlling shareholder influence.

– There is a case for the establishment of a body such as the Public Company Accounting Oversight Board (PCAOB) (that was established in the U.S. a few years ago), as that body would review the intensity and the integrity of audits by auditors on an annual basis.

– There is need for auditor rotation as it prevents creation of any affinity between auditors and controlling shareholders, and avoids “capture” of the audit process by insiders in companies.- Auditor liability is currently an unresolved question, and the affixation of liability for malfeasance needs to be clearly defined. In some countries, the public regulatory authorities (such as the securities regulator) could directly initiate action against auditors and the merits of such an approach require careful consideration.

– Other precautionary processes may help as well. This could include meetings between audit committee members and auditors without the presence of management.

Independent Directors

Independent directors tend to be in an unenviable position. Unless there are any red flags or warnings in a company’s operations, it is difficult to pinpoint board failure per se. For example, a board that receives false information, without any other warnings, is in a tough spot. Further, in controlling shareholder situations, the independent directors are often appointed by the controlling shareholders, and may hence owe a sense of responsibility to those shareholders. Having said that, the current norms on corporate governance in India do not go far enough to deal with independence of the board in controlling shareholder situations. Some of the possible reforms are as follows:

– Making nomination committees mandatory for Indian companies. Currently, there is no requirement to have nomination committees, although several companies have established such committees voluntarily. When independent directors are chosen by an independent nomination committee and without the influence of controlling shareholders, there is a sense that it would instill greater independence of such directors from the controlling shareholders

– Other processes relating to the functioning of independent directors may induce greater credibility in board decision making. These include:

– The requirements of lead independent directors

– Executive sessions among independent directors without the presence of management

– Appointment of advisors (such as lawyers and accountants) by independent directors to advise them on significant transactions involving a company. Such advice would be provided independent of the management or controlling shareholders.

– More fundamentally, there needs to be a re-evaluation of who appoints independent directors. Under the current system, they are appointed by the shareholder body as a whole, which is often considerably influenced by the controlling shareholder. What is required is a reform to consider other methods of appointing independent directors. For instance, they can be appointed by a majority of the minority shareholders, whereby the controlling shareholders do not have a say on the matter. Alternatively, there may be proportionate representation on boards of listed company where all shareholders have some level of say in appointment of directors and that the board is not dominated by controlling shareholder nominees. For example, in such a system, the minority shareholders obtain the right to elect such number of directors in proportion to the percentage holding of such minority shareholders. [Note: The system of proportional representation is already available under the Companies Act, in Section 265, but is only optional]

– Moving from a regulatory perspective into standards of conduct and ethics, perhaps it would be useful for industry bodies such as the Confederation of Indian Industry (CII) to draw up guidance for directors that would help independent directors clearly determine what is expected of them in the boardroom.

Investor Activism

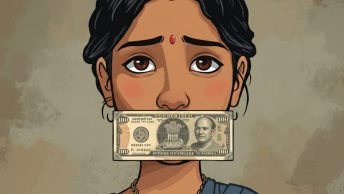

There is greater need for activism on the part of the investors directly. Often, that is not possible because of the lack of coordination among various investors, referred to as the collective action problem. One method by which this has been resolved in the U.S. is through the existence of proxy consultants such as Institutional Shareholder Services or Risk Metrics who knit together coalitions of investors to actively play a role in significant decisions involving a company. Similarly, an active business press would also play an important role in enhancing governance practices.

These are some of the key recommendations emanating from the panel discussion. Clearly, there is recognition that none of these systems will be failsafe. However, the solution in these circumstances is that if a number of such systems are put in place, it would reduce the statistical likelihood of things turning sour from a governance standpoint.

A very good article. I wish you had elaborated on the need for auditor rotation. Would you say a Company should be forced to use a different auditor every 3 years?

Do you think an ‘independent director’ serves any purpose since they are also appointed at the instance of the controlling shareholder? Wouldn’t it be better to have a ‘quota’ system whereby any shareholder with more than say, 10% of a Company’s shares is entitled to proportional representation on the board? This could be 5% in the case of large companies. This would ensure that institutional investors have a director on the board, though I should confess that many institutional investors bargain and obtain this right in any event. May be SEBI should consider nominating directors to boards of very large listed companies.

Winnowed, thanks for your comments. Yes, auditor rotation is where a company is required to change is auditors every once in a while (say 3 years or 5 years). The logic is to avoid any affinity being generated by the company management and the auditors. Moreover, even where no malfeasance is involved, it is always better to get a “fresh pair of eyes” to review the company’s accounts that auditors who are there for a long while may tend to have missed.

As for independent directors, one solution will be proportional representation so that minority shareholders also get to appoint such number of directors as their percentage of shareholding in the company. Currently, without proportional representation being made mandatory, a majority shareholder can appoint all directors (including independent directors). I am would not be enthusiastic about the idea of having SEBI appoint an independent director – well, that may work in case of dire situations such as Satyam where the Central Government appointed directors – but, otherwise in normal circumstances that decision is best left to the shareholders to be determined in a fair manner.